Mobilly benefits – modern employee motivation

Provide lunch and other services to your employees with Mobilly benefits.

Company provides benefits to employees

Available benefits and their limits visible on the app

Employees select merchants and make payments

Company receives a monthly invoice

Main Benefits

- Employee motivation

- New employee attraction

- Improved corporate image

- Tax cost savings

- Convenient system management

- Automatic report system

- Payment for the used benefits only

What do customers think about Mobilly benefits?

Tet

Ingrīda Rone, Member of the Board and CHRO

I am very glad that we chose Mobilly’s solution for employee payments for Tet benefits. It is an intuitive and convenient solution with a wide and constantly expanding range of service providers and our employees are very satisfied with it.

The solution has been successfully integrated with our other systems and the accounting of benefits is thus almost fully automated and easy to review.

In addition, cooperation with Mobilly staff has been great, as they provided a flexible and quick response to the emergency situation caused by Covid-19, offering payment for food delivery services, and have always offered an in-depth and personal approach, dealing with any questions or concerns of our employees.

SAF Tehnika

Ivita Rozīte, HR Manager

Mobilly benefits is a great and convenient tool for paying for various services by using the Mobilly app. A free lunch is one of the services that SAF Tehnika has been providing to its employees for 8 months now, in order to increase their well-being. It’s great that Mobilly is constantly adding new caterers to the list, taking our recommendations and our employees’ favourite places to go for lunch into account. In addition, Mobilly benefits also has the option to pay for lunch with delivery to the home or office. We are convinced that the free lunch also acts as an effective additional motivator in attracting new employees.

On the other side, this solution also allows our company to save on labour force taxes if compared to adding the same amount of money to our employees’ salaries.

We are happy to see that the number of transactions increases every month and that this bonus is becoming more and more popular within the company. Consequently, we have concluded that the use of Mobilly benefits for lunch payment has become a pleasant and appreciated part of daily life at our company.

LIC Gotus

Atis Švinka, Chairman of the Board

Mobilly benefits is a very convenient service that is easy to use in daily life.

Transport

Lunch

Medical and Sports Services

Gifts, events

Remote job

Other Services of Your Choice

Save! Benefits without Taxes

The law stipulates that the employer may pay for the employee’s meals, not exceeding EUR 480 per year (an average of EUR 40 per month) and that for these expenses they do not have to pay personnel taxes, i.e. social tax and income tax (more information in Section 8, Paragraph 15 of the Law “On Personal Income Tax”). Requirements:

- A collective agreement with employees.

- The employer employs at least 6 employees.

- Catering expenses of all employees specified in the collective agreement and paid by the employer do not exceed five per cent of the total annual gross salary fund of the employer.

- The employer has no tax (duty) debts.

- The employer has carried out economic activities for at least one complete calendar year before the taxation year in which the exemption application is commenced in respect of employees.

- Insolvency proceedings have not been declared for the employer, its economic activities have not been suspended, nor is it under liquidation.

- The employer, upon such a decision of a competent authority or a court ruling which has entered into effect and has become not subject to appeal, has not been found guilty of an infringement within two taxation years (more information in Section 8, Paragraph 15 of the Law “On Personal Income Tax”).

New Changes — in the 2021 tax year, the employee’s expenses related to the performance of telework, which are paid for by the employer in accordance with the Labour Law, are exempt from taxation if their total amount per month does not exceed 30 euros for full-time work. More information in the Law “On Personal Income Tax”, Paragraphs 159, 160, and 161 of the Transitional Provisions.

Where can I pay with Mobilly benefits?

If you are a merchant and want to cooperate, please email – [email protected]

Before ordering your food, please contact the merchant to agree on the delivery terms (e.g. delivery time, minimum order amount)

Using the benefits

Employers

Upon entering into an agreement with Mobilly, the company receives its own customer profile in the Mobilly app and passwords for the Benefits Control Panel. The company can add new employee accounts, remove inactive employee accounts, define benefit categories, assign benefits, and top up benefit accounts in the Benefits Control Panel.

The law stipulates that the employer may pay for the employee’s meals, not exceeding EUR 480 per year (an average of EUR 40 per month). For these expenses, the company does not have to pay personnel taxes, i.e. social tax and income tax. Read more about this in Section 8, Paragraph 15 of the Law “On Personal Income Tax” at https://likumi.lv/ta/id/56880-par-iedzivotaju-ienakuma-nodokli.

In order to receive tax relief, a collective agreement with employees is required.

Mobilly has created a sample collective agreement that is available in the customer profile. For a collective agreement to enter into force, it must be signed by 51% of employees. Employees and employers can sign a collective agreement with an electronic signature or by authenticating via the SEB/Swed/Citadele banks.

The Benefits Control Panel will show how many and which employees have signed the collective agreement.

Employees

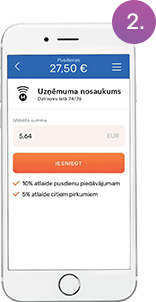

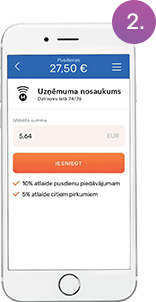

The employee selects a merchant/service provider on the map or scans a QR code

At the time of payment, the customer enters the final amount given by the merchant and submits the payment

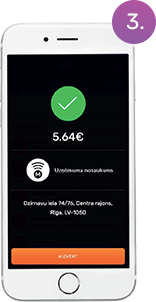

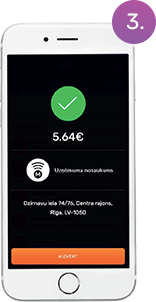

Once confirmation has been received, the merchant makes a receipt for an identical amount, indicating that the payment was made with Mobilly

Ko par labumiem saka darbinieki

Jānis

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Ilze

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Gatis

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Samanta

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Merchants

The customer finds the service provider on the map or scans the QR code and enters the purchase amount

The merchant verifies and confirms the purchase by pressing IESNIEGTS (SUBMITTED) on the customer’s phone

Once confirmation has been received, the merchant makes a receipt for an identical amount, indicating that the payment was made with Mobilly

Payment Process

The merchant receives a report and payment for actual transactions from Mobilly on the first business day of each week. On the last business day of each month, the merchant receives a final report* on transactions from Mobilly.

- If the month ends in the middle of the week, then, in this week, one report and payment will be made for all transactions that took place until the last day of the month and another report and payment for the first days of the month that fall in the current week.

Upon entering into an agreement with Mobilly, the company receives its own customer profile in the Mobilly app and passwords for the Benefits Control Panel. The company can add new employee accounts, remove inactive employee accounts, define benefit categories, assign benefits, and top up benefit accounts in the Benefits Control Panel.

The law stipulates that the employer may pay for the employee’s meals, not exceeding EUR 480 per year (an average of EUR 40 per month). For these expenses, the company does not have to pay personnel taxes, i.e. social tax and income tax. Read more about this in Section 8, Paragraph 15 of the Law “On Personal Income Tax” at https://likumi.lv/ta/id/56880-par-iedzivotaju-ienakuma-nodokli.

In order to receive tax relief, a collective agreement with employees is required.

Mobilly has created a sample collective agreement that is available in the customer profile. For a collective agreement to enter into force, it must be signed by 51% of employees. Employees and employers can sign a collective agreement with an electronic signature or by authenticating via the SEB/Swed/Citadele banks.

The Benefits Control Panel will show how many and which employees have signed the collective agreement.

The employee selects a merchant/service provider on the map or scans a QR code

At the time of payment, the customer enters the final amount given by the merchant and submits the payment

Once confirmation has been received, the merchant makes a receipt for an identical amount, indicating that the payment was made with Mobilly

Ko par labumiem saka darbinieki

Jānis

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Ilze

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Gatis

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Samanta

Uzņēmums

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

The customer finds the service provider on the map or scans the QR code and enters the purchase amount

The merchant verifies and confirms the purchase by pressing IESNIEGTS (SUBMITTED) on the customer’s phone

Once confirmation has been received, the merchant makes a receipt for an identical amount, indicating that the payment was made with Mobilly

Payment Process

The merchant receives a report and payment for actual transactions from Mobilly on the first business day of each week. On the last business day of each month, the merchant receives a final report* on transactions from Mobilly.

- If the month ends in the middle of the week, then, in this week, one report and payment will be made for all transactions that took place until the last day of the month and another report and payment for the first days of the month that fall in the current week.

Frequently Asked Questions

- The customer enters into an agreement with Mobilly

- Mobilly creates a customer section with a logo in the app

- The customer pays a security deposit

- Mobilly sends the company system access and provides training for using the system

- The company enters into a collective agreement with its employees

- The customer enters the names, surnames, and phone numbers of their employees and assigns benefits

The fee is calculated as follows: price for “benefits” or services + Mobilly commission fee + VAT). Monthly invoice.

Price includes:

- Creation and maintenance of a customer profile

- Training on how to use the system

- Customer service

- Subscription fee

- Ensuring cooperation with merchants

Mobilly commission fee: 7% for companies with up to 200 employees, 5.5% for companies with more than 200 employees. Integration and connection to external systems (if necessary): price evaluated separately.

If no system integration is necessary, Mobilly benefits can be connected within two days after signing the contract.

Companies have the option to erase any leftover balance in EUR at the end of each month. If the leftover balance is not erased, it gets transferred to the next month.

Mobilly takes customer recommendations into account, signing new agreements with the service providers that the Mobilly customers would like to visit.

Ask Your Question

Mobilly benefits Developer — SIA MobillyTX https://mobillytx.com/

MobillyTX is a company of Mobilly Group. MobillyTX develops customised solutions for public, municipal, and private companies.

e-mail: [email protected]